-

About

The Digital Government of the United Arab Emirates is spearheading the digital transformation of government entities, in line with its strategy and vision to establish an Emirati digital government of global excellence.

Digital Government is responsible for driving digital transformation in the UAE by implementing services, policies and initiatives to deliver a world-class digital government.

Digital Government is responsible for driving digital transformation in the UAE by implementing services, policies and initiatives to deliver a world-class digital government.

-

Your Voice

For the Digital Government, innovation means connecting to people anytime, anywhere. We want to engage with individuals, businesses and the public on our services and policies in an interactive environment that enhances digital well-being for our society.

DGOV follows the digital participation guidelines provided by the Federal E-Government of the UAE.

DGOV follows the digital participation guidelines provided by the Federal E-Government of the UAE. Please have your say and participate in the decision-making through our list of latest consultations.

Please have your say and participate in the decision-making through our list of latest consultations.

We are interested in your input to support sustainable digital transformation across the UAE.

-

Services

Discover how our services and initiatives drive digital transformation success for individuals, businesses, and governments across the UAE.

UAE Verify

Your trusted platform for issuing, certifying and verifying the validity of your digital documents.

UAE PASS

Your secure digital identity to access multiple e-services using one account only.

FedNet

Connecting UAE federal government entities for secure and seamless service integration

DGOV Academy

Your first destination to gain skills, knowledge and support your professional career.

UAE Hackathon

Join the region's largest event of its kind and participate in exploring innovative ideas.

UX Lab

Your innovative lab designed to assess the user experience before launching the service.

Sharik.ae

Your gateway to e-participation, empowering citizens and residents to share their views and ideas and participate in the development of government policies and service.

Design System for Federal Governments Websites

Everything you need to design a clean, consistent, and user-friendly federal website.

-

Publications

Gain deeper insights into digital transformation in the UAE by exploring our strategies, guidelines, policies, and comprehensive reports.

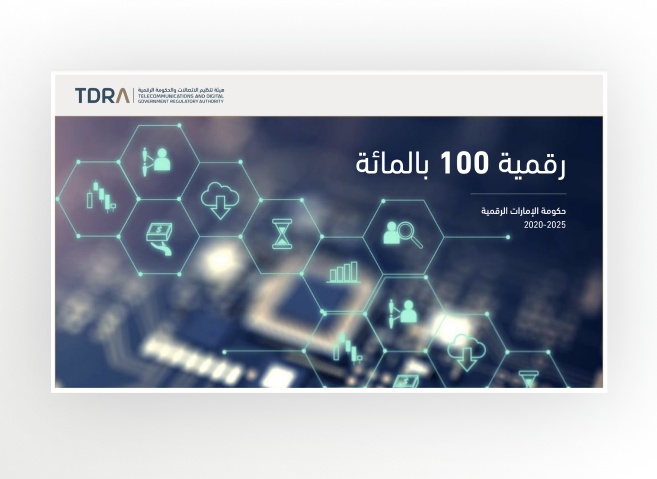

The future of digital growth in the UAE. A pathway to 100% digital transformation.

The future of digital growth in the UAE. A pathway to 100% digital transformation. Guidelines for acceptable usage of the internet across the UAE.

Guidelines for acceptable usage of the internet across the UAE. Guidelines to help federal entities enhance their digital presence and service offering.

Guidelines to help federal entities enhance their digital presence and service offering. Guide to API-first design and development of APIs for UAE government entities.

Guide to API-first design and development of APIs for UAE government entities. Policy on how to provide proactive digital government entities services.

Policy on how to provide proactive digital government entities services. Policy on providing all government services through a single unified platform.

Policy on providing all government services through a single unified platform.

-

Media Hub

Discover the impact of digital government initiatives and services through the latest news, success stories, and prestigious awards.

Explore how our services and initiatives drive digital transformation success for individuals, businesses, and governments across the UAE.Stay informed about DGOV's latest news, including the launch of services and initiatives, and milestones in the UAE digital transformation journey.

Explore how our services and initiatives drive digital transformation success for individuals, businesses, and governments across the UAE.Stay informed about DGOV's latest news, including the launch of services and initiatives, and milestones in the UAE digital transformation journey. -

Audience

Digital Government is responsible for supporting digital transformation for individuals, businesses and government entities by providing services tailored to meet the needs of each audience.

The Digital Government offers services, systems, and infrastructure that empower businesses and government entities to innovate and collaborate, enhancing knowledge and driving digital transformation throughout the UAE.

The Digital Government offers services, systems, and infrastructure that empower businesses and government entities to innovate and collaborate, enhancing knowledge and driving digital transformation throughout the UAE. The Digital Government provides services, systems, and infrastructure enabling government entities to establish a premier digital government, aligned with the UAE's Digital Government Strategy.

The Digital Government provides services, systems, and infrastructure enabling government entities to establish a premier digital government, aligned with the UAE's Digital Government Strategy. The Digital Government provides innovative services, policies, and initiatives that enable government entities to implement digital transformation, improving the online experience for citizens, residents, and visitors in the UAE.

The Digital Government provides innovative services, policies, and initiatives that enable government entities to implement digital transformation, improving the online experience for citizens, residents, and visitors in the UAE.

-

Contact

You can contact us through the form and we will respond within a working day.

We’re here to help. Contact us or review our frequently asked questions.

We’re here to help. Contact us or review our frequently asked questions.